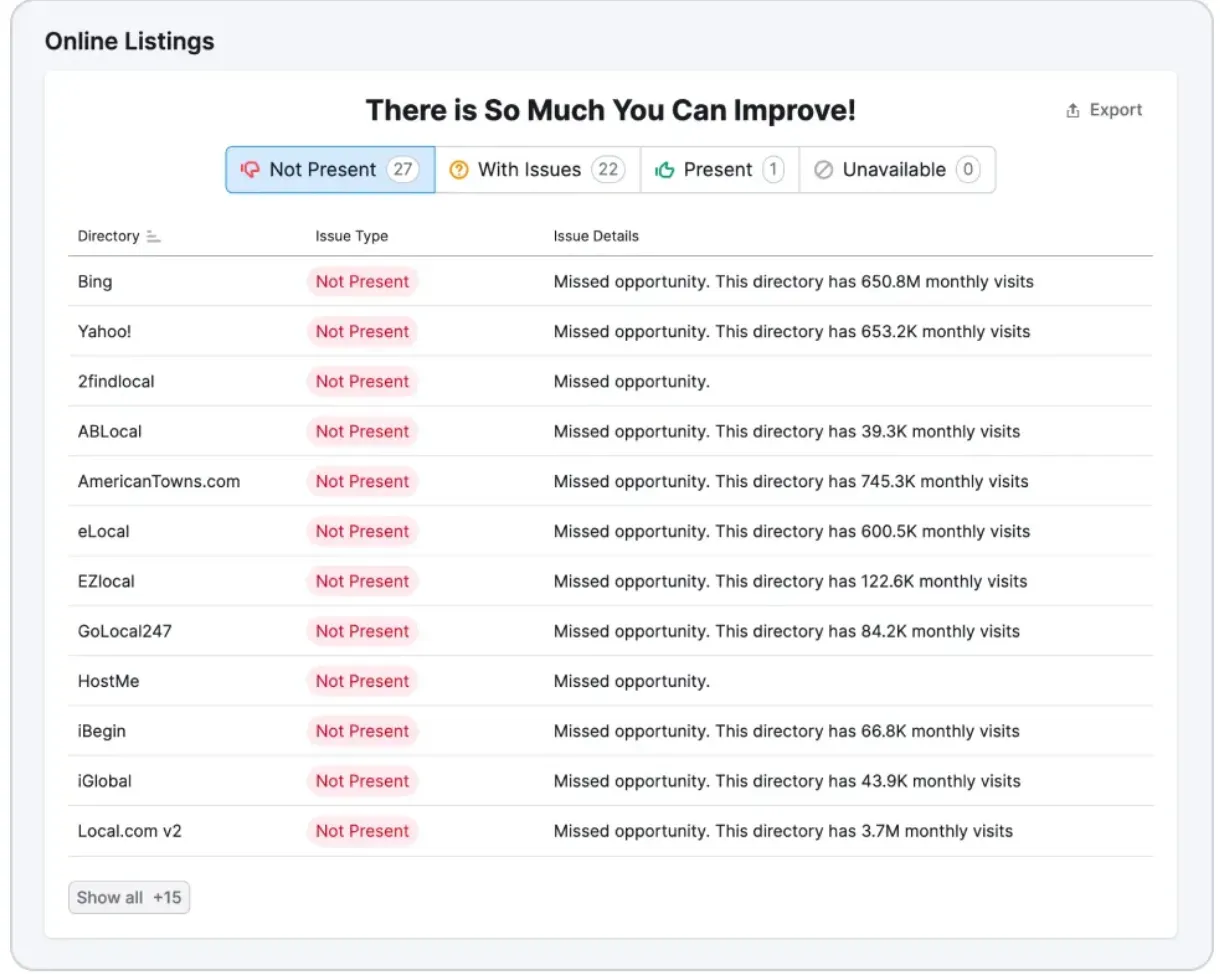

Reinventing Your Technique to GBP Administration

In the world of global financial markets, managing the British Pound (GBP) requires a thorough and critical strategy that goes past traditional techniques. As the characteristics of the GBP market continue to evolve, experts are charged with reevaluating their administration methods to remain in advance of the contour.

Recognizing GBP Market Dynamics

The understanding of GBP market characteristics is critical for making educated choices in international exchange trading. The GBP, additionally recognized as the British Extra pound, is one of the most traded money in the globe.

Financial indications play a substantial function in shaping the GBP's efficiency. Secret variables to keep an eye on consist of GDP growth, rising cost of living rates, unemployment numbers, and rate of interest decisions by the Bank of England. Favorable economic data usually strengthens the extra pound, while adverse information can bring about depreciation.

Geopolitical events can additionally influence the GBP's worth. Brexit, for example, has been a significant driver of volatility in the last few years (linkdaddy google business profile management). Modifications in federal government plans, trade agreements, and international events can all influence market belief and the GBP's instructions

Implementing Risk Administration Approaches

Leveraging Innovation for GBP Evaluation

Using sophisticated technological tools enhances the precision and efficiency of analyzing GBP market patterns and dynamics. AI algorithms can identify patterns and correlations in the GBP market, offering important insights for decision-making.

Additionally, data visualization devices play a crucial role in streamlining intricate data establishes right into conveniently absorbable charts and charts. These devices allow experts to identify opportunities, fads, and anomalies rapidly. Additionally, machine understanding formulas can be trained to predict GBP market activities based on historic data, helping to lead calculated decisions.

Branching Out GBP Investment Portfolios

With a strong foundation in leveraging modern technology for GBP evaluation, financial specialists can now tactically diversify GBP financial investment profiles to enhance returns and mitigate dangers. Diversity is a fundamental concept that GBP management involves spreading financial investments across various asset courses, industries, and geographical areas. By branching out a GBP profile, investors can minimize the impact of volatility in any type of solitary asset or market industry, possibly boosting overall efficiency.

One effective method to expand a GBP investment portfolio is by alloting assets across different sorts of safeties such as equities, bonds, realty, and commodities. This method can aid stabilize the portfolio's risk-return profile, as various property classes have a tendency to act differently under various market conditions.

Surveillance GBP Efficiency Metrics

To effectively assess the performance of a GBP investment portfolio, monetary experts have to concentrate on vital efficiency metrics that give understandings right into its productivity and threat monitoring. Surveillance GBP efficiency metrics is critical for making educated choices and enhancing portfolio results. One crucial metric to track is the profile's rate of return, which shows the earnings of the financial investments over a certain period. Comparing this go back to a benchmark index can aid examine the portfolio's performance about the market.

Volatility metrics such as common discrepancy and beta are also vital signs of risk. Typical variance measures the diffusion of returns, highlighting the portfolio's stability or variability, while beta analyzes its level of sensitivity to market movements. Understanding these metrics can assist in handling risk exposure and changing the portfolio's allotment to fulfill preferred risk degrees.

In addition, tracking metrics like Sharpe ratio, information ratio, and drawdown evaluation can give deeper insights into risk-adjusted returns and downside security. By systematically checking these performance metrics, economic specialists can make improvements GBP financial investment strategies, enhance performance, and better navigate market fluctuations.

Conclusion

To conclude, revolutionizing the method to GBP management involves understanding market dynamics, implementing threat administration techniques, leveraging innovation for analysis, diversifying investment profiles, and monitoring efficiency metrics. By including these crucial elements into your GBP management strategy, you can enhance your decision-making procedure and accomplish greater success in browsing the intricacies of the GBP market.

With a strong foundation in leveraging modern technology for GBP analysis, economic experts can currently tactically branch out GBP investment portfolios to maximize returns and reduce threats.

Luke Perry Then & Now!

Luke Perry Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Batista Then & Now!

Batista Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!